38+ what is real estate taxes on mortgage

Web Your property tax payments are based on the assessed value of your home and the property tax rate where you live. Web Whenever you obtain a mortgage some state and local governments levy a mortgage recording tax to document the loan transaction.

Dead Cow Creek Rd Red Bluff Ca 96080 Realtor Com

Web Mortgage interest is the amount of interest that was paid on your mortgage loan.

. Web The most recent real estate tax assessment values the property at 280000 of which 252000 is for the home and 28000 is for the land. Web Real estate income taxes. Skip to content Learn Get.

Web You pay 1000 toward the principal and interest 150 toward property taxes 100 toward homeowners insurance and 50 in HOA dues. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Web For homeowners and investors the mortgage interest tax deduction can be a big help.

State and local real property taxes. Web Here is a list of states in order of lowest ranking property tax to highest. That is the amount you claim.

It is paid when you. Web The mortgage recording tax is used to document the loan transaction. Web Property taxes are the amount that is levied upon any real estate property which the homeowner has to pay annually to the government or Municipal Corporation of the area.

This fee is separate from. Your real estate income is everything you earn from rents on the property less any. Web A 1031 exchange is a real estate investing tool that allows investors to swap out an investment property for another and defer capital gains or losses or capital gains.

Real Estate Tax Rate. Web January 30 2022 1159 AM The property taxes listed on the 1098 form is what your lender paid to the taxing agency on your behalf. Keep in mind if your monthly mortgage payment includes an.

Web If the home was acquired after December 15 2017 the home acquisition debt limit is 750000. In the prior years mortgage interest deductions allowed to deduct up to 1 million dollars. Web Trump Tax Rules.

Property taxes are the amount of taxes that the county or city charges you for. For example the current tax rate in Toronto is. Effect on Real Estate.

Learn about the rules limits and how to claim it. Or 375000 if married filing separately. Web Yes and maybe.

Web Back in 2012 multiple sources announced that all real estate transactions will be subject to a 38 federal sales tax as of January 2013. This is separate from mortgage interest and other annual property taxes. Web As long as the real estate tax was paid you can deduct it regardless if your document shows it or not.

Rental income is taxed as ordinary income.

0 Spring Mountain Road Saint Helena Ca 94574 Mls 322084882 Listing Information Lee Miller Premier Real Estate Expert

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Are Property Taxes Included In Mortgage Payments Smartasset

Zero Point Mortgage Services Mortgage Brokers You Can Trust

The Impact Of Property Tax On Your Mortgage Trelora Real Estate

Understanding Property Taxes Home Loans

0 Fm 1413 146 Dayton Tx 77535 Mls 34583198 Zillow

Are Property Taxes Included In Mortgage Payments Sofi

792 Frontage Rd 2116 Rowe Nm 87562 Mls 202234077 Zillow

6 Hanni Street Sidney Ny 13838 Mls Id Od136812 Timberland Properties

Real Estate 09 07 14 By Localiq Issuu

25 Governors Lane Hilton Head Island 29928

Property Taxes And Your Mortgage What You Need To Know Ramsey

Ftolsuhlitmuvm

Race And Housing Series Mortgage Interest Deduction

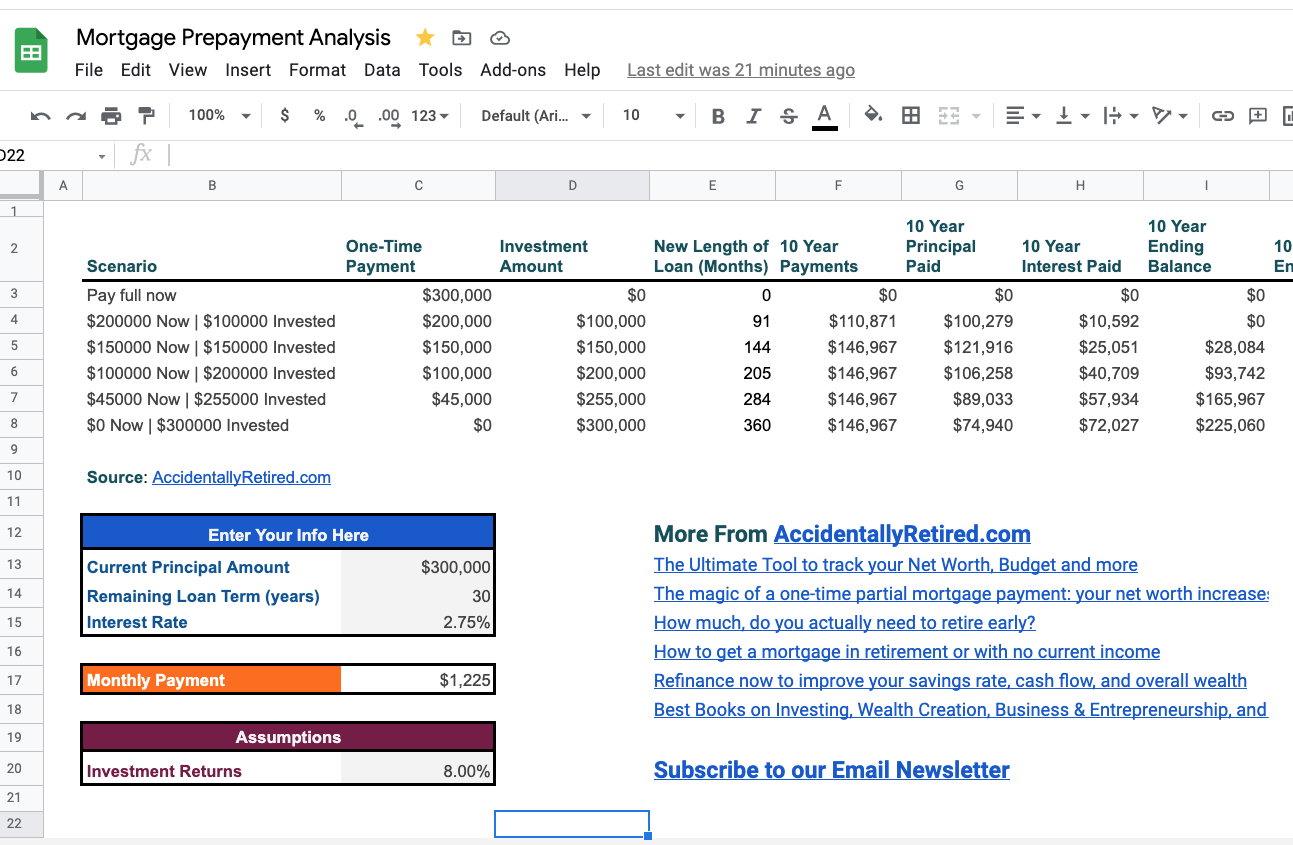

Pay Off Mortgage Vs Invest Calculator

Prompt Realty Mortgage Inc Har Com